Adjusting Entry for Unearned Revenue

Adjusting Entry for Unearned Revenue

: :29-09-22, 9:42 sáng |

| Adjusting Entry for Unearned Revenue |

|---|

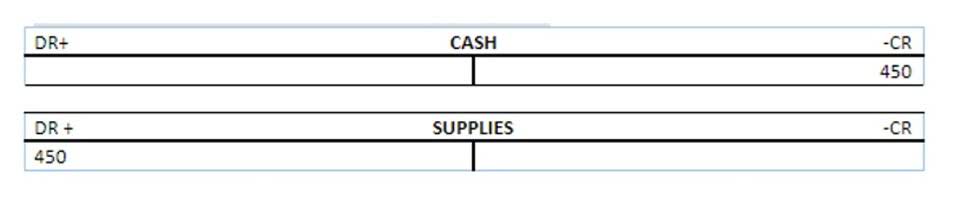

Once goods or services have been rendered and a customer has received what they paid for, the business will need to revise the previous journal entry with another double-entry. This time, the company will debit its unearned revenue account while crediting its service revenues account for the appropriate amount. Unearned revenue should be entered into your journal as a credit to the unearned revenue account and as a debit to the cash account. This journal entry illustrates that your business has received cash for its service that is earned on credit and considered a prepayment for future goods or services rendered. Accounting for Unearned Rent Revenue

It is recorded as a liability because the company still has an outstanding obligation to provide these goods or services. By understanding and properly accounting for unearned revenue, businesses can maintain accurate financial records and ensure that their financial statements reflect their true financial position. Properly managing unearned revenue is crucial for industries such as software or subscription-based services where prepayments are the norm. Various adjustments and corrections may also be required as the company continues to provide the goods or services it has received payment for and gradually “earns” the revenue.

Unearned Revenue: Decoding Its Significance in Business AccountingIn accrual accounting, a liability is a future financial obligation of a company based on previous business activity. Liabilities are often oversimplified as the debt of a company that must be paid in the future. A variation on the revenue recognition approach noted in the preceding example is to recognize unearned revenue when there is evidence of actual usage. Financial Analysis and Transparency

Revenue recognition for unearned rent occurs as the rental period progresses and the space is utilized by the tenant. According to the accrual basis of accounting, income is recognized when it is earned, regardless of when the payment is received. Therefore, at the end of each accounting period, a portion of the unearned rent revenue is transferred to the earned revenue account to reflect the rent that has been earned during that period. How Current Liabilities WorkDeferred revenue is classified as a liability because the recipient has not yet earned the cash they received. The company must satisfy its debt to the customer before recognizing is unearned rent a current liability revenue. The payment is considered a liability because there is still the possibility that the good or service may not be delivered or the buyer might cancel the order. How to Record Unearned RevenueIt represents the money received by a company for goods or services that have not yet been delivered. When a company receives payment before rendering the service or delivering the product, it must recognize this receipt as a liability on its balance sheet. In summary, unearned revenue is a vital concept within accrual accounting, helping provide a more accurate representation of a company’s financial position. By understanding and accurately recording unearned revenue, businesses can better manage cash flow and service obligations to their customers. In accounting, unearned revenue has its own account, which can be found on the business’s balance sheet. Funds in an unearned revenue account are classified as a current liability – in other words, a debt owed by a business to a customer.

Unearned revenue is great for a small business’s cash flow as the business now has the cash required to pay for any expenses related to the project in the future, according to Accounting Tools. Accrued expenses are costs of expenses that are recorded in accounting but have yet to be paid. Accrued expenses use the accrual method of accounting, meaning expenses are recognized when they’re incurred, not when they’re paid. For example, on December 29, 2020, the company ABC receives an early cash payment of $2,000 for the rental property it provides to the client. In contrast, commercial leasing deals with long-term contracts that may include renovations or build-out periods where the usable space isn’t provided immediately but still incurs rent payments.

Revenue Recognition PrincipleAlso, the contract often provides an opportunity for the lender to actually sell the rights in the contract to another party. Proper reporting of current liabilities helps decision-makers understand a company’s burn rate and how much cash is needed for the company to meet its short-term and long-term cash obligations. If misrepresented, the cash needs of the company may not be met, and the company can quickly go out of business. However, each accounting period, you will transfer part of the unearned revenue account into the revenue account as you fulfill that part of the contract. Revenue is recorded when it is earned and not when the cash is received. If you have earned revenue but a client has not yet paid their bill, then you report your earned revenue in the accounts receivable journal, which is an asset.

Current Liabilities: What They Are and How to Calculate ThemThe second journal entry is in compliance with the GAAP rules and accrual accounting principles though. Below is a current liabilities example using the consolidated balance sheet of Macy’s Inc. (M) from the company’s 10-Q report reported on Aug. 3, 2019. Car loans, mortgages, and education loans have an amortization process to pay down debt. Amortization of a loan requires periodic scheduled payments of principal and interest until the loan is paid in full. |

| Back to list |

02-0000-0000

02-0000-0000 02-0000-0000

02-0000-0000 0ddd@dddd.com

0ddd@dddd.com